Loans, Lines of Credit, and Credit Cards: How Small Businesses Are Working with Financial Partners to Navigate Economic Pressures Findings from the 2023 Small Business Credit Survey.

Based on the 2023 Small Business Credit Survey by the Federal Reserve, the 2024 Report on Employer Firms highlights several key findings about some new and lingering challenges facing small businesses in the United States. Though the effects of the COVID-19 pandemic continued to wane, more than 9 in 10 firms experienced either a financial or operational challenge in 2023.

Financial Challenges Facing Businesses and Their Responses

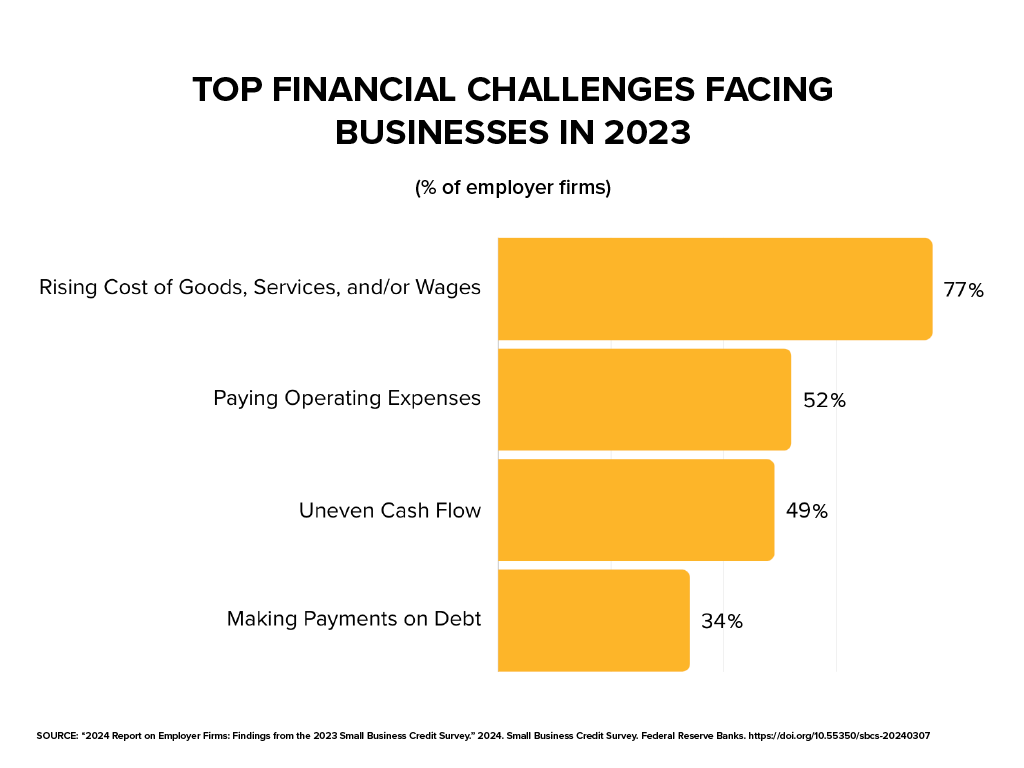

Rising costs and the need to pay operational expenses have exacerbated financial strain on small businesses. This strain is particularly pronounced for businesses that had to take on additional debt to survive during the pandemic but are now facing slower revenue growth and increasing expenses.

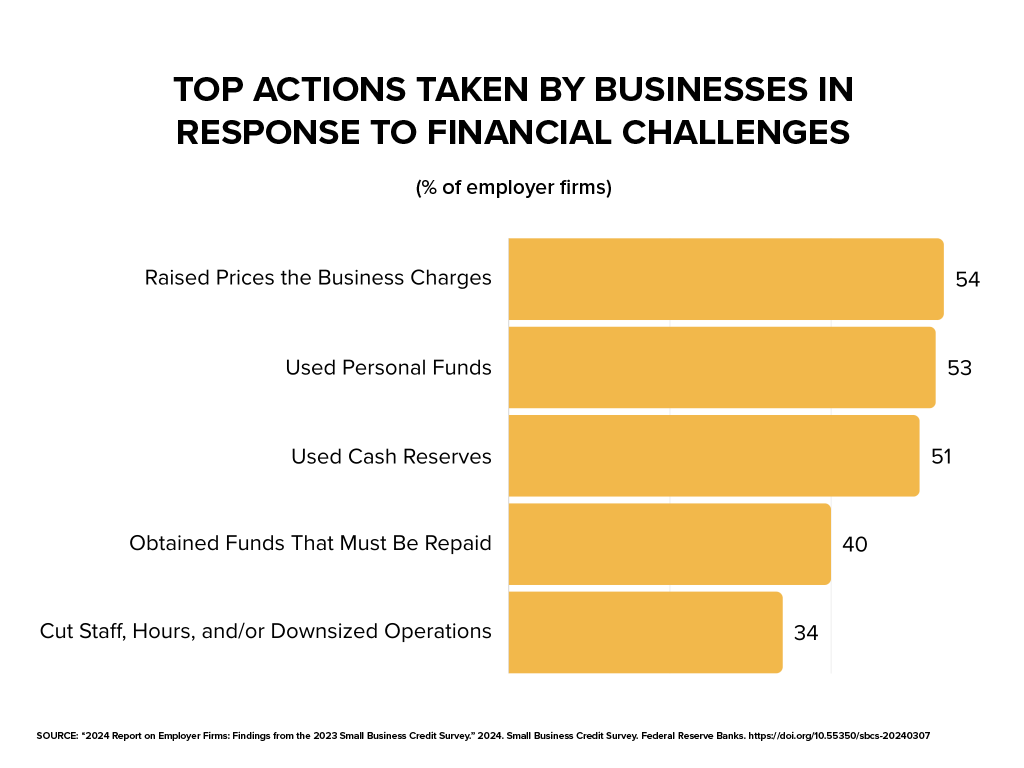

In response to the financial challenges, businesses pursued a variety tactics. Many businesses raised their consumer-facing products, while others focused on cost management strategies which included reducing overhead expenses and adjusting workforce costs. In over half of the instances, business owners relied on personal funds to mitigate the financial burden.

Business Financing and Reasons for Applications

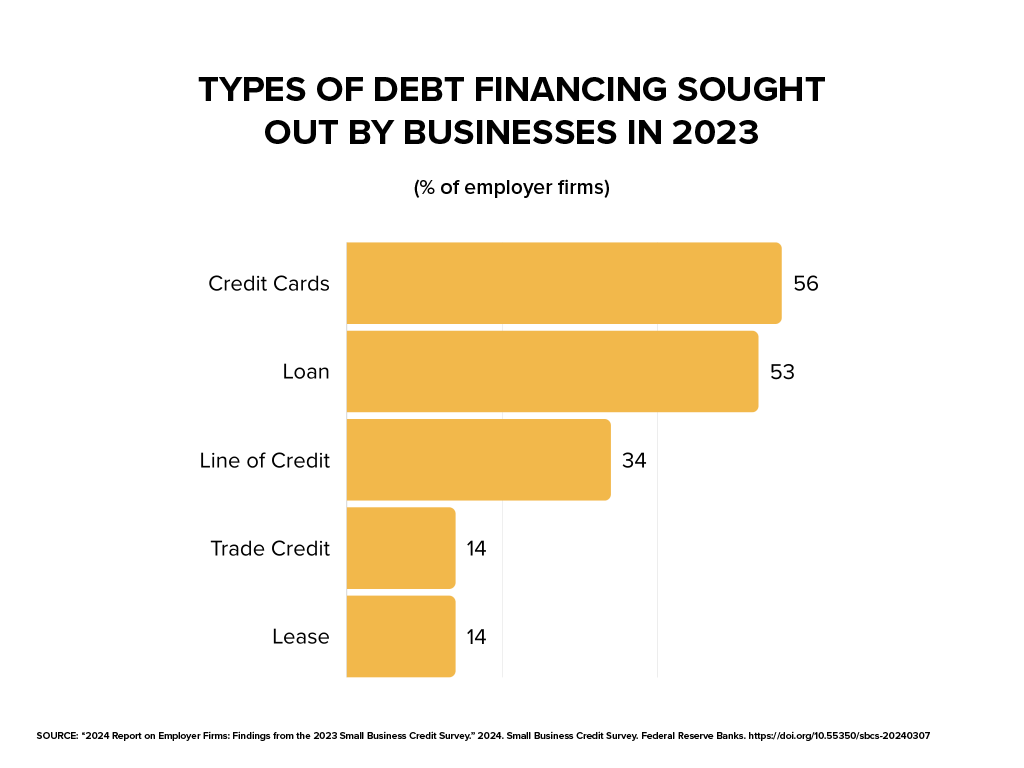

For businesses that sought out funds from outside parties, various types of financing were utilized to navigate the ongoing economic challenges. Small banks were a common source of debt financing, working with businesses to obtain loans (both traditional and government-guaranteed) as well as services such as lines of credit. Lines of credit were a flexible financing option that businesses used to manage short-term cash flow needs. Businesses preferred these institutions due to their higher approval rates and better customer satisfaction compared to larger banks and other lenders.

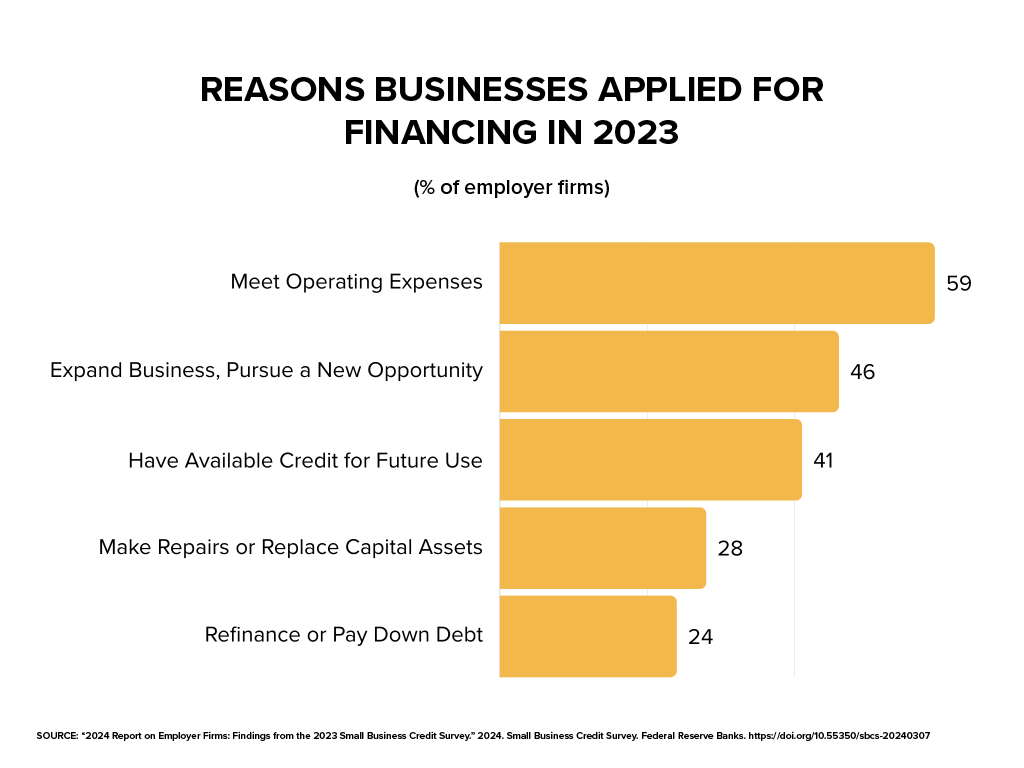

The most common reason firms sought out small business loans was to manage day-to-day operational expenses. This included paying for inventory, rent, utilities, and other essential costs to keep the business running smoothly. Many firms faced cash flow challenges due to delayed payments from customers or seasonal fluctuations in revenue. Financing helped bridge these gaps and ensure they could meet their financial obligations on time.

Expansion and growth also drove many businesses to apply for funding. Some businesses applied for loans to fund expansion plans, such as opening new locations, purchasing new equipment, or increasing their product or service offerings. Conversely, refinancing existing debt allowed firms to take advantage of better interest rates or more favorable terms.

How Boulder Banking Can Benefit Your Business

Banks were the most sought-after provider of funding and credit for businesses. While more businesses applied to large banks (44%) over small banks (28%) for credit, small banks surpassed their larger peers when it came to loan approval rates (52% and 44%, respectively) and lender satisfaction (79% and 61%, respectively).

At Stone Bank, our Boulder Bankers are committed to understanding your business’s financial health, identifying the solutions that best fit your needs, and assisting you on the path to success. Beyond providing banking services, we’re partnering with businesses to secure funding and implement financial tools to reduce unnecessary expenses.

Our business products and services include:

✓ Quartz Free Business Checking

✓ Business Credit Cards*

✓ Emerald Treasury Management Services Includes:

Merchant Services

Remote Deposit

Wire Transfers

Cash Handling

Zero Balance Accounts

ACH & Payroll

Credit Card Processing

LOC Sweep

Positive Pay

✓ Small Business Lending** Includes:

SBA Loans

USDA Loans

FSA Loans

Conventional Loans

✓ Complimentary Meeting Space***

✓ Dedicated Small Business Success Partner

Curious to see how Stone Bank can help bolster your bottom line? Our business banking professionals are ready to help. Call (833) 253-2265, visit one of our branches, or click the button to reach out.

“2024 Report on Employer Firms: Findings from the 2023 Small Business Credit Survey.” 2024. Small Business Credit Survey. Federal Reserve Banks.

SOURCE: Federal Reserve

SOURCE: CAMEO Network

*All rates, fees, and disclosures will be provided prior to account opening. Rates are subject to change. Early withdrawal penalties apply. Other fees or restrictions may apply. Fees will reduce earnings.

**Loans subject to credit approval and other program requirements. Call (833) 253-2265 for details.

***Based on availability.