Improving Business and Economic Growth.

Stone Bank is dedicated to the improvement, development, and growth of businesses and industries in rural America.

With the USDA Loan program, we can support the economic climate in rural communities while also helping larger businesses with financing needs.

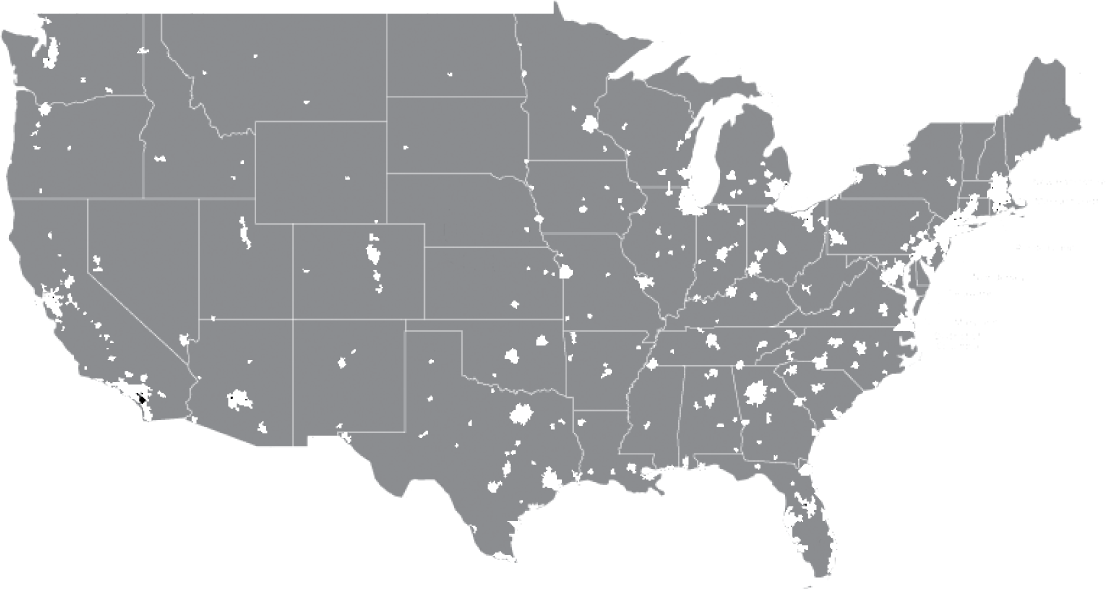

97% OF U.S. BUSINESSES

QUALIFY FOR A USDA LOAN.

By choosing a USDA Business and Industry Loan, your business financing is provided through a government program that targets businesses in rural areas. With the Business and Industry program, loans originated by private commercial lenders are guaranteed by the government in areas of 50,000 people or fewer, thereby improving economic health in such rural areas. Benefits of the USDA loan program include better interest rates and longer repayment terms.

USDA Real Talk

Debbi Whitlock, Great White Express Car Wash

SBA Real Talk: David Billings’ Testimonial

USDA Real Talk: Rural Hospital Group Testimonial

Growing Our Communities

Stone Bank offers business owners USDA guaranteed loans to cover a variety of rural business expenses. These loans promote small businesses in rural communities and create jobs.

Businesses that may qualify for this program are:

✓ For-Profit Businesses

✓ Nonprofits

✓ Cooperatives

✓ Public Bodies

✓ Individuals

✓ Federally Recognized Tribe

Types of Loans:

✓ Business and Industrial

✓ Rural Energy for America Program (REAP)

✓ Solar, Wind, LED Grants Available

✓ Biofuel